Prop. 19, What it Means to You and How to Get Around It …

Disclaimer: Nothing in this recording or blog should be construed as legal advice. All viewers need to consult with an attorney and/or tax expert with regard to the topics discussed herein as every situation is unique and there are no guarantees of any particular result or outcome. There are no assurances that the information contained herein is accurate, reliable, timely or complete.

Wondering about Prop. 19? Here’s what it means to you and how to get around it. Under current law (Proposition 58), parents can transfer their personal residence and other real property (with certain limitations) to their children, either during lifetime or at death, and such transfers may be excluded from property tax reassessment. However, Proposition 19 (or Prop. 19), a ballot measure that recently passed, makes significant changes to the property tax law relating to transfers of CA real property between parents and children. Prop 19 also changes the property tax rules for CA residents age 55 or older who wish to transfer their existing property tax base from a current residence to a new home. We have included a video that describes the current CA property tax rules and then explain the effects of Prop. 19. One of the best parts is that it also has information on how to get around Prop. 19!

5 Things To Do Over the Christmas Break, Part 2!

Top 5 Things To Do During The Christmas Break …

Top 5 Things To Do During the Christmas Break. Make great memories and experiences with friends and family.

Set to Impress …

Chef Austin - Our Young Adult Children and a Favorite Recipe

Young Adult Children Will Surprise us with their purpose in life. From coming up with recipes, spending time with family, and more. It’s time to make memories with our children. Included is a Colombian dessert recipe.

Cannot Wait to Move In Early!

The New York Deli …

A taste of New York, right here in Los Angeles. The New York Deli does not disappoint. Fantastic pastrami and other sandwiches. Check out the history of the delicatessen.

Increase Your Net Worth? I Thought That Was Just for Businesses

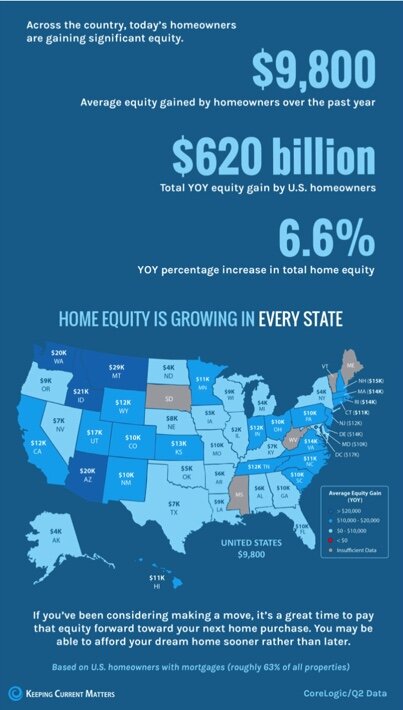

What Will You Do With Your Equity?

Whether staying in your home or thinking of selling your home, it’s important to know what you can do with your equity and how it has changed. Some things include adding an ADU or maybe buying another property.

Who to Contact When Moving

How to Have Options Through Your Home Equity

Bicycling In Paris …

TIPS ON HOW TO PREPARE FOR A HOME INSPECTION

Affording That Dream Home …

True Blue . . .

To Buy or Not To Buy, That is The Question

How Is Your Equity? (The Net Value of Your Home)

Beachy Space …